After a certain number of attempts the IRS may stop accepting eFiled returns from you and/or lock your account. Step 1: DO NOT just keep submitting or re-eFiling your 2022 return over and over again with the same 2021 AGI amount expecting different results. In case you have done all this already and you still get rejected please read the following. Then, click the green Continue button, and enter the correct 2021 AGI as listed on your 2021 Tax Return in the box on the next screen.

Problem: Your tax return either got rejected because the 2021 AGI amount you enter does not match IRS records, or the 2021 AGI you entered is correct, but the IRS has not processed your 2021 return, thus they can't match the amount.Ģ021 AGI Solution: Sign into your account: click File on the left side menu, and follow the on-screen prompts until you reach the screen asking you if you filed a 2021 tax return last year: select Yes or No.

This is the result of unprocessed returns at the IRS. As a result, even though the 2021 Adjusted Gross Income amount you was entered correctly by you the filing taxpayer, the IRS might still reject it. The number of Tax Return rejections by the IRS-not -has increased this year over previous years.

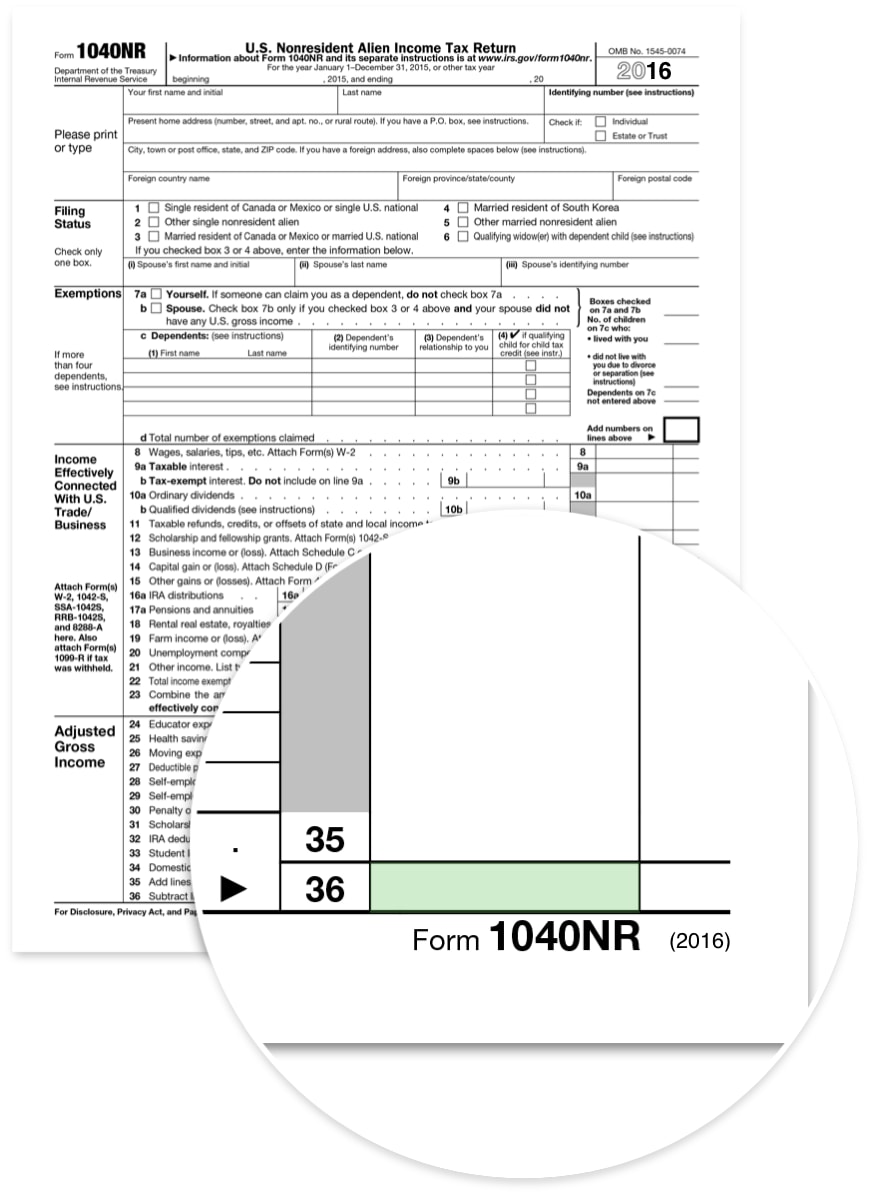

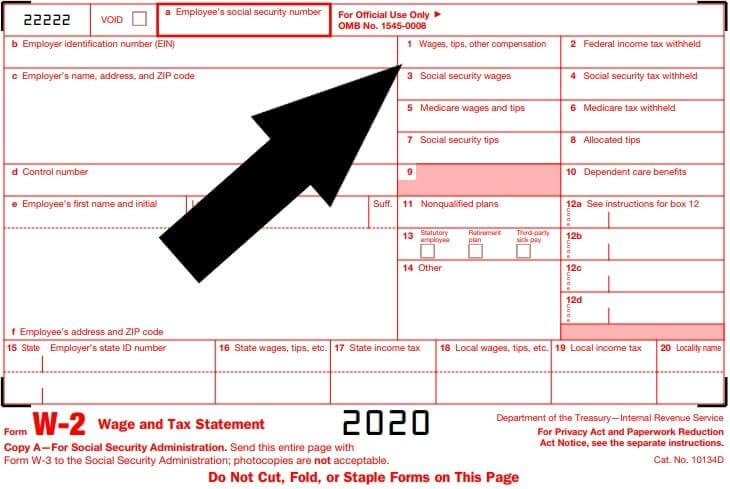

When you prepare and eFile your tax return, your Adjusted Gross Income (AGI) from the previous year is used to validate your identity and to sign your return.Īttention: Did your IRS Return get rejected by the IRS even though you did enter the correct 2020 AGI?

0 kommentar(er)

0 kommentar(er)